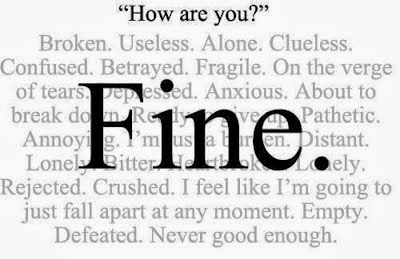

Recently, I wrote about how widows can often be targeted as an open wallet for other people — unscrupulous con-artists, well-meaning advisors and sales people, and even family members. Today, let’s look closer at that last category and in particular adult children who continually come to mom for financial support. I understand the emotional aspects … Read More

How to Stop Being an Open Wallet for Your Adult Children